Franchise Profit vs. Owner Paycheck: What New Franchisees Must Know

Why Your Franchise Profit Isn’t Your Paycheck

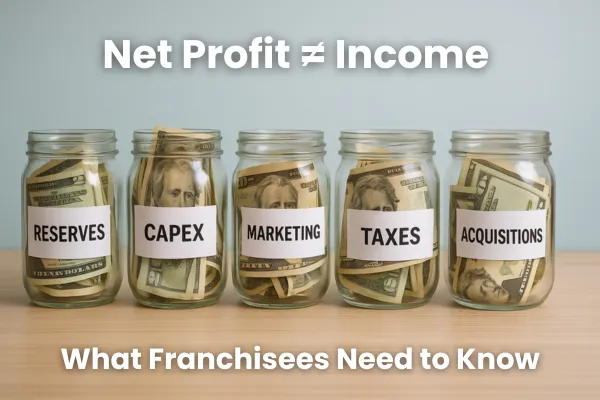

One of the biggest shocks for new franchisees is realizing that net profit does not equal what you can pay yourself.

Here’s why:

1. You Need Reserves

Most businesses keep 2–3 months of expenses on hand. Without that cushion, one bad month could sink you. You will start with some working capital to get the business going, but as expenses increase due to business growth your reserve will have to grow as well. This addition will come from your net profit.

2. CAPEX Is Coming

Growth requires investment: trucks, equipment, new locations. If you spend all your profit, you won’t have capital when growth opportunities arise. This savings account needs to be separate from your cash reserves- this is dedicated to your next purchase but can’t be at the cost of risking ruin to your business because you spent all your reserves.

3. Marketing Comes Before Sales

If you want more revenue next month, you must pay for ads this month. That eats into “profit” today but fuels tomorrow’s growth. You are going to take next month’s marketing out of this month’s profit.

4. Taxes

Ignore them and you’ll regret it- ask me how I know. Set aside a portion of profit for quarterly and annual payments. On top of business taxes, you should set aside a reserve for your own tax bill since you aren’t being paid like a normal W-2 employee and may have a substantial personal tax bill at the end of the year.

5. Opportunistic Growth Fund

One of the best parts of being a franchisee is you can grow through purchasing a business that works just like yours. This makes integration into your current operations much easier than buying a random independent business. However, to capitalize on this opportunity you need a growth fund so you can make offers to buy franchisees who need a quick exit. This is how some of the biggest franchisees grew- they bought out distressed franchise neighbors pennies on the dollar. You have to grow this fund with savings taken out of profit.

What Does This Mean for You?

Early on, you may need to:

Take a small, steady salary (budgeted before launch).

Reinvest most of your net profit back into the business.

Delay big distributions until reserves and growth are funded.

Understand the various savings you need to make on a monthly basis so you don’t pay yourself at the expense of your business’ long term viability.

Franchisees who understand this distinction avoid financial stress and scale faster.